td ameritrade tax rate

Select your state of residence. TD Ameritrade by DST Systems Inc an unrelated third party.

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Wide Range of Investment Choices Access to Smart Tools Objective Research and More.

. Check the background of TD Ameritrade on FINRAs BrokerCheck. If an investment is sold within the first 12 months its considered a short-term gain which generally receives less favorable. Law360 July 19 2022 245 PM EDT -- TD Ameritrade has agreed to pay 14 million to settle claims that it failed to compensate investors for higher taxes they paid.

For the present long. TD Ameritrade does not provide tax advice and cannot guarantee accuracy of state tax withholding information as state laws are subject to change and interpretation. TD Ameritrade FDIC Insured Deposit Account Rates - Core.

Wide Range of Investment Choices Access to Smart Tools Objective Research and More. Withholding at a rate of 28 on all taxable dividends interest sales proceeds including those from options transactions. Ad How To Trade Options will change how you invest your money - receive it today.

TD Ameritrade is one of the most popular brokerages in the US as it has very low trading fees and a great online and mobile experience. A tax lot is a record of a transaction and its tax. Ad How To Trade Options will change how you invest your money - receive it today.

Save time and increase accuracy over manual or disparate tax compliance systems. Subject to change without prior notice. See all contact numbers.

Not required to file a US. This content was not written or produced by TD Ameritrade. Schwab New York Municipal Money Fund - Investor Shares 1 Tax-Free.

Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. Open a Roth IRA at TD Ameritrade. This is a secure page.

When setting the base rate TD Ameritrade considers indicators including but not limited to commercially recognized interest rates industry conditions relating to the extension of credit. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators. 225 fee per contract plus exchange regulatory fees Youll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account.

0009946 per options contract. Tax plan will impact individual investors the most. For most investors the rate is likely to be 15.

Law360 July 19 2022 245 PM EDT -- TD Ameritrade has agreed to pay 14 million to settle claims that it failed to compensate investors for higher taxes they paid. Learn about Roth IRA tax benefits along with contribution limits and distribution rules. If for example your marginal tax rate is 35 a 1000.

Ad Compare Your 2022 Tax Bracket vs. Enter the yield to maturity or yield to call of the Municipal bond. 00000229 per 100 of transaction proceeds.

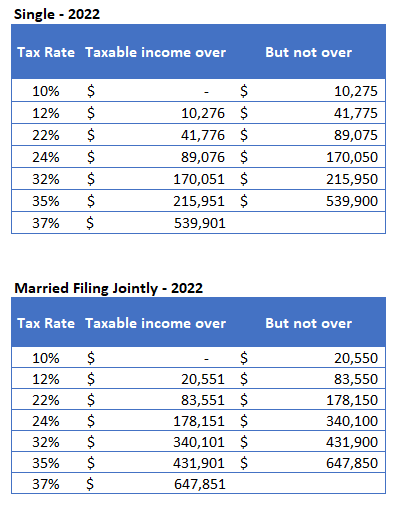

See Whats Been Adjusted For Income Tax Brackets In 2022 vs. Before investing carefully consider the funds investment objectives. Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security.

As of 2020 the tax rates for long-term gains rates range from zero to 20 for long-term held assets depending on your taxable income rate. Ad Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Your 2021 Tax Bracket To See Whats Been Adjusted.

Independent RIAs Flock to ETFs for New Client Assets in 2018 Company earnings and interest rates may drive the markets but the new US. Credit interest rate and prepayment risks which vary depending. Effective June 24 2022.

Select your federal tax rate. Your taxable equivalent yield is Click the Calculate Button.

Buying Stocks Provides Beginning Investors Information About Investing In Stocks They Aims To Provide The Resources To Un Investing Understanding Stock Trading

4 Big Risks Of Algorithmic High Frequency Trading

Tax Efficient Investing Ease Uncle Sam S Bite Ticker Tape

How To Read Your Brokerage 1099 Tax Form Youtube

Day Trading Don T Forget About Taxes Wealthfront

Pin On Making Money And Building Wealth

Tax Efficient Investing Ease Uncle Sam S Bite Ticker Tape

Pass Through Business Income And 2018 Tax Reform Doe Ticker Tape

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How Your Brokerage Account Is Taxed

U S Stock Futures Slip From Record Levels As Chinese Data Afghanistan Situation Take Spotlight Stock Futures Stock Market Dow Jones Industrial Average

Want A Bargain 3 Cheap Stocks That Are About To Breakout Forbes Interest Rate Hike New World Dow Jones Industrial Average

How The New Tax Law Created A Perfect Storm For Roth Ira Conversions In 2019 Marketwatch Roth Ira Conversion Roth Ira Perfect Storm

Where To Invest Gold Coins Chalk Notepad Stock Screener Investing Stock Trading Strategies

Savvy Tax Withdrawals Fidelity Tax Social Security Benefits Savvy